Introduction

The Federal Reserve has significantly raised interest rates from approximately 0% to around 5% in the past year. This major shift in monetary policy has set off a series of consequences that will unfold in three distinct stages: a regional bank crisis, a commercial real estate (CRE) crisis, and a government debt crisis. Specific factors drive each set, but all are interconnected and have far-reaching implications for the financial system. This article will examine each step in detail, exploring the underlying mechanisms and potential consequences and supporting our arguments with relevant research and data.

Stage 1: The Small/Regional Bank Crisis

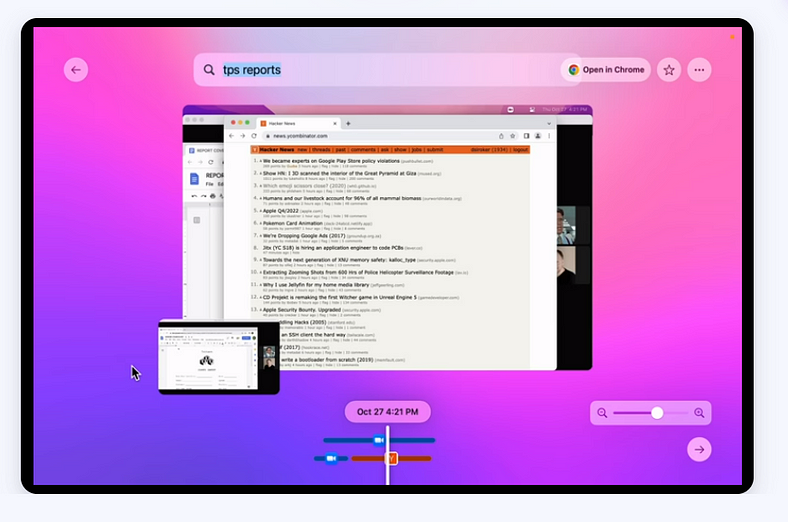

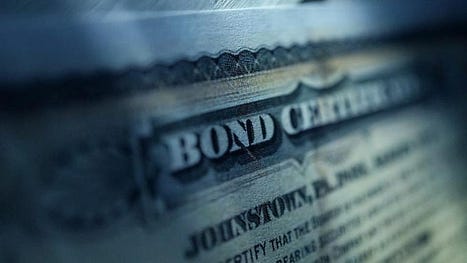

The initial effect of the Federal Reserve’s interest rate hike is a decrease in the value of bonds, particularly long-dated bonds. Bond prices fall as interest rates rise, leading to unrealised losses for banks with significant holdings in these assets. Regional and smaller banks are particularly vulnerable to these fluctuations due to their relatively concentrated bond portfolios and dependence on interest income.

The resulting erosion of bank capital may lead to bank failures and consolidations as weaker institutions cannot weather the losses. This, in turn, can lead to reduced lending capacity and liquidity problems in the financial system.

Stage 2: The Commercial Real Estate (CRE) Crisis

The second stage of the crisis is driven by the increasing cost of borrowing, which directly impacts the commercial real estate sector. Higher interest rates make it more expensive for borrowers to finance large purchases like real estate, resulting in declining demand and property values.

Additionally, higher borrowing costs can lead to defaults on existing loans, impairing the CRE loan portfolios of banks and other financial institutions. As the credit markets tighten, new loans become scarce, exacerbating the issue. The fallout from this crisis stage could be widespread, affecting not only banks and property owners but also investors, developers, and businesses that rely on commercial real estate.

Stage 3: The Government Debt Crisis

The third and final stage of the crisis emerges from the increased cost of government borrowing. Higher interest rates translate to higher debt service costs at the federal level, exacerbating budget deficits at the state and local levels. These heightened fiscal pressures can lead to cuts in public spending, tax increases, and even sovereign debt issues at the international level.

As governments grapple with these financial challenges, the risk of a broader economic downturn becomes more pronounced. Reduced public spending and potential austerity measures can stifle growth, while uncertainty surrounding sovereign debt issues can create volatility in global markets.

Conclusion

The Federal Reserve’s decision to raise interest rates from near zero to approximately 5% has set in motion a domino effect with far-reaching consequences for the global financial system. Through a three-stage process involving regional bank crises, commercial real estate downturns, and government debt challenges, the ripple effects of this monetary policy shift will likely be felt across a range of sectors and regions. Policymakers, financial institutions, and investors must remain vigilant in monitoring these developments and preparing for the potential fallout.

Backlinks: