The COVID-19 pandemic has dramatically altered global business landscapes, prompting industries to adopt innovative practices to cater to changing consumer preferences. One sector that has capitalised on this shift is the ‘Pao Tui’ industry in China. With its ability to deliver everything from food to pharmaceuticals, the Pao Tui sector is redefining convenience in the post-pandemic era.

A Market Overview: Emergence and Expansion

China’s Pao Tui, the delivery industry, has recorded tremendous growth over the last five years. From 2017 to 2022, the industry saw a surge in order volume, from 8.31 billion to 40.00 billion. This 381.34% increase translates to an average year-over-year growth rate of 48.90%, a testament to the industry’s resilience amidst the global pandemic.

In tandem with the surge in order volume, the industry’s revenue figures experienced a significant boost. From a revenue of CNY 70.40 billion (US$9.96 billion) in 2017, the Pao Tui industry escalated its earnings to CNY 200.00 billion (US$28.28 billion) in 2022. This 184.09% jump equates to a compounded annual growth rate (CAGR) of 23.22%, further illuminating the industry’s economic potency.

The rising user numbers also show the escalating demand for delivery services. From a relatively modest 290 million users in 2017, the industry boasted 750.00 million users in 2022, marking a 158.62% increase. The expansion of the user base indicates a shift in consumer behaviour towards a preference for delivery services.

Understanding the "Pao Tui" User: Occupation, Gender, and Geography

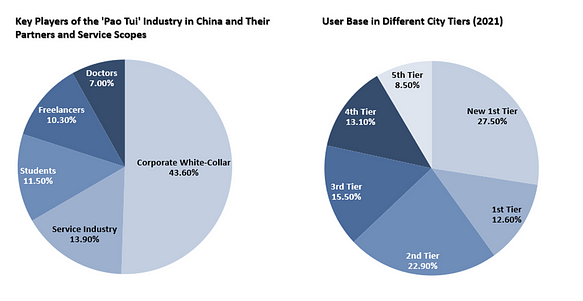

A closer look at user occupation proportions offers exciting insights. Corporate white-collar workers comprise a considerable chunk of the user base, constituting 43.60% of the total users. This segment is followed by service industry personnel (13.90%), students (11.50%), freelancers (10.30%), and doctors (7.00%). These figures suggest that busy professionals and students rely heavily on delivery services, reflecting a trend towards convenience and time-saving solutions.

Regarding gender distribution, male users outpace female users in the Pao Tui industry. In 2022, the male user base was 454.50 million compared to 295.50 million female users. This pattern may hint at differing gender-based consumption habits, with more men opting for the convenience of delivery services.

Geographically, the Pao Tui industry has the most substantial presence in new first-tier cities, accounting for 27.50% of total users. First-tier cities comprise 12.60% of users, while only 36.60% come from third to fifth-tier cities. This data indicates the spread and penetration of the Pao Tui industry across different urban tiers in China.

Generation Z and “Pao Tui” Service: Embracing the New Wave

The acceptance and demand for “Pao Tui” services are experiencing a significant shift with the rise of Generation Z (people aged 18–25). Notably, the TGI index, a measure of product popularity among different age demographics, indicates a strong preference for “Pao Tui” services among this age group.

As per the TGI index, Generation Z scores 150.00 for the “Pao Tui” service, surpassing other age groups, which is a testament to their adoption and acceptance of these instant delivery services. This high score reflects their openness to novel consumer experiences and digital solutions.

While the older generations are also increasingly embracing these services — demonstrated by their growing use for grocery shopping — Generation Z is leading the way, signalling a bright future for the “Pao Tui” industry.

Competing in the Pao Tui Landscape: Key Players and Business Models

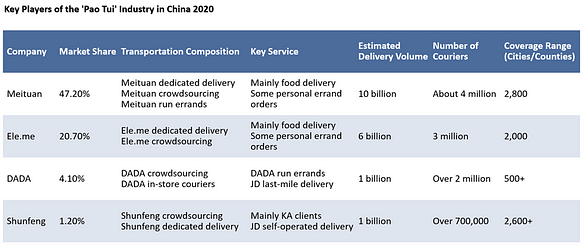

The Pao Tui industry features major players like Meituan, Ele. Me, DADA, and Shunfeng, each contributing to the industry’s flourishing landscape with its unique business models and service offerings.

Meituan, with its substantial delivery volume of ten billion orders and approximately four million couriers, dominates the industry. Despite suffering a net loss of CNY61.75 billion (US$8.69 billion) in 2022, the company kept its delivery costs relatively low at 36.4% of its revenue, CNY80.19 billion (US$11.29 billion). Its primary service offering revolves around food delivery, with some personal errand orders.

On the other hand, DADA and Shunfeng maintain a worse financial position. DADA registered a minor net loss of CNY2.20 billion (US$31.00 million), keeping its delivery costs at 111.60% of its revenue of CNY10.49 billion (US$1.48 billion). The company excels in running errands and providing last-mile delivery for JD. Shunfeng recorded a profit of CNY430 million (US$60.52 million), keeping its delivery cost at 94.81% of its revenue of CNY9.74 billion (US$1.37 billion)— the company’s service centres around Key Account (KA) clients and JD’s self-operated delivery.

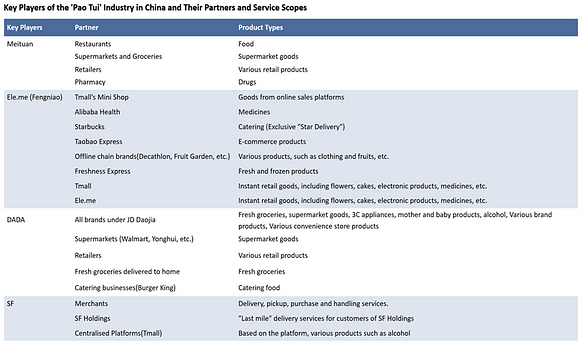

A key element contributing to these companies’ success is their strategic partnerships. For example, Meituan partners with restaurants, supermarkets, and retailers to provide various products, from food to retail. Similarly, Ele. Me, powered by Alibaba, collaborates with online platforms like Tmall’s Mini Shop and offline chain brands to deliver multiple goods.

The Pao Tui Industry: Future Prospects

The Pao Tui industry, backed by robust growth metrics, shows immense potential for expansion. The following factors are anticipated to shape the industry’s trajectory:

Section 1: User Demands and Habits

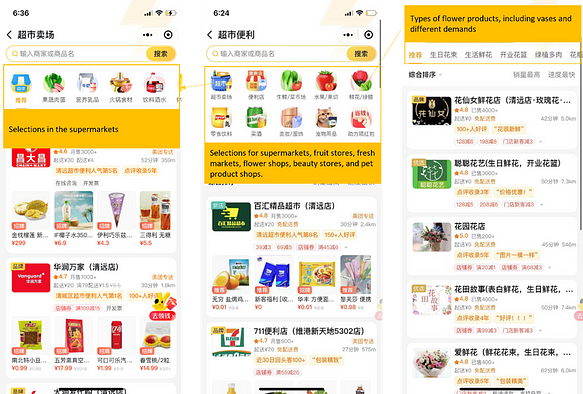

As modern life accelerates, consumers increasingly prioritise convenience, speed, and variety when choosing services. A prime example of this trend in the instant logistics industry is the widespread use of “Pao Tui” services. Particularly popular among the younger, well-educated demographic, these services are perceived as a convenient solution to their busy lifestyle or a respite for the “lazy” moments. This trend underscores the potential for further industry growth, catering to modern consumers’ evolving needs.

“For me, the ‘hourly delivery’ of instant retail is more time-saving and effortless, and now it’s not just catering; everything can be delivered. For example, if I wanted to buy something, I used to have to drive, ride, or run, and it would take an hour or two back and forth. Now it’s delivered in less than half an hour, greatly facilitating my life.” Chen, born after 1995, can’t stop praising instant retail.

Section 2: The Elderly Population and Its Significance

China’s rapidly ageing population offers an unprecedented opportunity for the instant logistics industry. As per the 2023 data, the population aged 60 and above has reached 264.02 million. Studies suggest that about 50% of this ageing demographic, approximately 132.00 million, suffer from various chronic diseases. This revelation illustrates the urgent need for tailored services, such as pharmaceutical deliveries that can cater to the unique needs of the elderly population.

For instance, Kangmei Medical has introduced a service that delivers drugs within 4 hours after a consultation. Offering medication dispensing, traditional Chinese medicine decoction, and drug delivery services, Kangmei Medical can handle up to 17,000.00 prescriptions daily. This demonstrates the vast potential in the market for instant pharmaceutical delivery.

Interestingly, this age group’s acceptance of online shopping has steadily increased. However, Target Group Index (TGI) data reveals that the usage remains relatively low for those over 50. Nevertheless, this demographic presents a pivotal market opportunity with their stable income and substantial purchasing power.

In 2021, according to the population census report, individuals aged 60 and above accounted for 18.70% of the total population, reaching a count of approximately 264.02 million (with those aged 65 and above making up 13.50% of the total population). Compared to the previous year, the proportion of individuals aged between 15–59 increased by 1.35%, while the percentage of those 60 and older rose by 5.44%. In 2022, the population aged 60 and above increased by 12.68 million, raising the proportion by 0.90%. It is predicted that by 2030, the population aged 60 and above will reach 481.95 million.

In light of these demographic trends, there is an emergent need to develop instant logistics services dedicated to older people. This tailored approach will not only meet the distinct needs of this demographic but also unlock a massive, untapped market potential.

Section 3: Potential Growth in Lower-Tier Cities

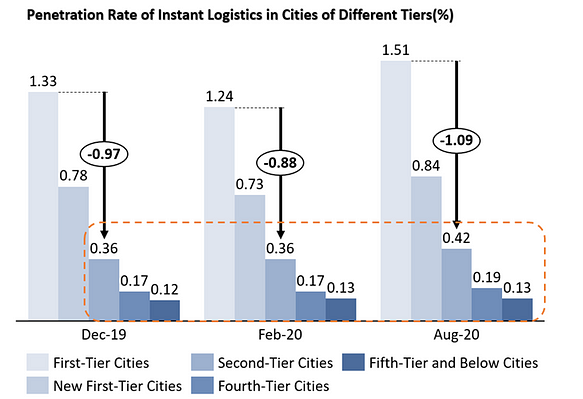

While first and second-tier cities in China currently account for the highest penetration rates of instant logistics, as reflected in the rates of 1.51 and 0.84, respectively, as of August 2020, significant growth potential exists in the lower-tier cities. This untapped potential can be observed in the steady, slower growth rates in fourth-tier cities (0.19 in August 2020) and fifth-tier and below cities (0.13 in August 2020). Understanding these lower-tier cities’ demographic and regional specifics is critical to exploit this growth potential. Tailoring service offerings to align with the unique needs and preferences of the inhabitants of these cities can maximise market penetration and drive the expansion of instant logistics.

Section 4: Policy Guidance and Support

Policies and regulatory guidance play a crucial role in shaping the industry landscape. A detailed examination of existing and upcoming policies can shed light on the direction of the industry and potential opportunities and challenges. Leveraging this understanding, companies can strategies their growth plans in alignment with the regulatory environment.

Section 5: Technological Advancements

In an era of rapid technological advancements, companies like Meituan, DADA, and Shunfeng invest heavily in technology to enhance their operations. For instance, Meituan has invested in autonomous delivery vehicles and drone technology to improve logistics efficiency. The company also launched a 24-hour smart pharmacy, leveraging robotics to sort and distribute medications. Shunfeng, on the other hand, has developed a cloud-based system to better manage and deliver orders across multiple platforms. By understanding the tech investments of these industry leaders, insights can be gleaned about the direction of technological innovation in the “Pao Tui” industry.

Conclusion

In conclusion, the Pao Tui industry stands at an exciting crossroads. As companies navigate user demands, demographic changes, potential market growth areas, supportive policies, and technological advancements, the industry is poised to redefine convenience in the digital age. The future appears bright for this industry, driven by its unique ability to cater to the evolving needs of the modern consumer in the post-pandemic world.

Reference

“2022年- 中国即时配送行业研究报告”, https://pdf.dfcfw.com/pdf/H3_AP202302141583147240_1.pdf?1676404577000.pdf

“DADA即时零售迎风而起,万千好物即时可得”, https://pdf.dfcfw.com/pdf/H3_AP202207191576326042_1.pdf

“达达集团Q4及全年财报:京东到家已合作超九成百强商超,平台活跃门店超22万”, 9 Mar 2023, Sina https://finance.sina.com.cn/tech/roll/2023-03-09/doc-imykfkci0053267.shtml

“顺丰同城等4平台接入天猫即时配送,通达系流量遭蚕食?”, 10 Feb 2023, 36Kr, https://36kr.com/p/2125847412173832

“这一天来了,美团外卖无人机配送已达10万单”21 Dec 2022, E-commerce Newspaper, https://www.dsb.cn/205656.html

“Communiqué of the Seventh National Population Census”, National Bureau of Statistics of China, May 11, 2021, 第七次全国人口普查主要数据情况 — 国家统计局 (stats.gov.cn)

“聚焦即时零售新场景、新体验 美团亮相2022全球数字经济大会”, 29 Jul 2022, http://tech.china.com.cn/roll/20220729/389648.shtml

“构建共治体系,促进即时配送行业发展壮大”, 13 Mar 2023, China Thinktanks https://www.chinathinktanks.org.cn/content/detail?id=w6g40r96

《推动物流业制造业深度融合创新发展实施方案》,Aug 2021, https://www.ndrc.gov.cn/xxgk/zcfb/tz/202009/P020200909333031287206.pdf