I want to talk about regression to the mean because this will transform the investment industry.

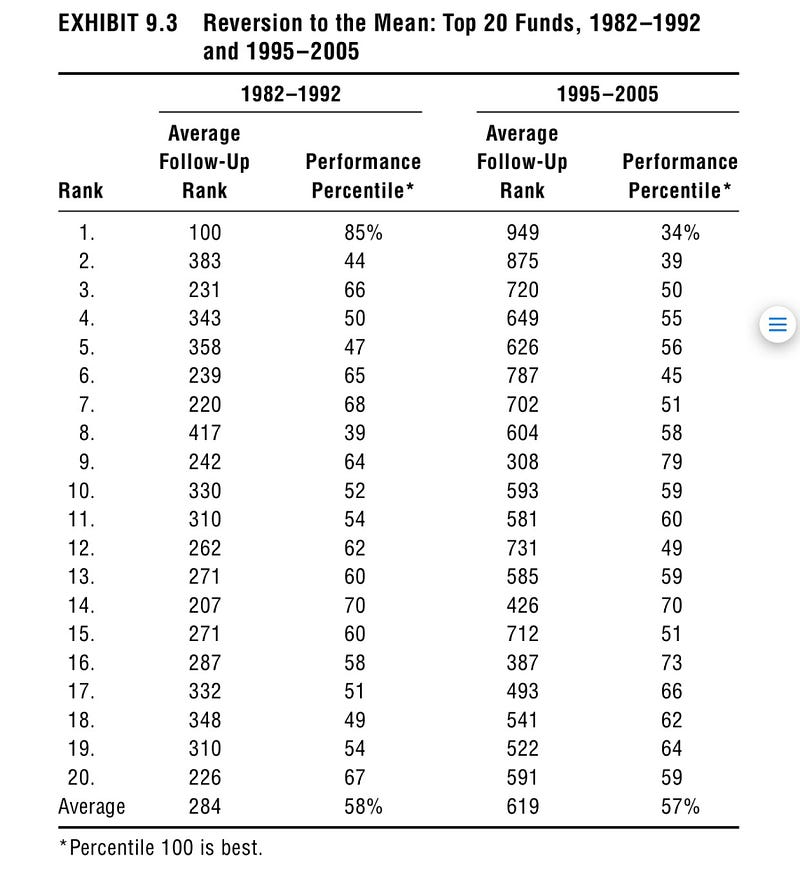

Look at the table above. Well performing funds do not stay at the top. They revert to the mean. This implies if you had bought a fund simply because it made good results in the past, you are more likely to lose. Simply put, if you came first, overtime you will underperform to emerge somewhere in the middle (the mean).

I get it that many professionals tell you they have insights. They print beautiful brochures. Anyone can report good results. Think about it this way, you came in 20th in a class of 40th. How do you show you did well? Well, you can say you were top 5 of those who went to the same club as you did. You could also say you were first in the entire neighborhood you stay in. These could be facts. But it does not take away the fact that you only came in 20th.

Look at the table above. Well performing funds do not stay at the top. They revert to the mean. This implies if you had bought a fund simply because it made good results in the past, you are more likely to lose. Simply put, if you came first, overtime you will underperform to emerge somewhere in the middle (the mean).

I get it that many professionals tell you they have insights. They print beautiful brochures. Anyone can report good results. Think about it this way, you came in 20th in a class of 40th. How do you show you did well? Well, you can say you were top 5 of those who went to the same club as you did. You could also say you were first in the entire neighborhood you stay in. These could be facts. But it does not take away the fact that you only came in 20th.

- Fund performance is hypothesized to be random

- Cost and fees are everything. Buy the cheapest that gives you the broadest diversification

- Please buy funds yourself, direct, not through advisors. They take a big cut