Singapore, the Lion City, has a housing model admired worldwide. The Housing Development Board (HDB) flats, which provide affordable homes for over 80% of Singapore’s resident population, are integral to the city’s unique urban landscape. However, a rising affordability concern regarding these flats has been simmering beneath the surface, warranting an in-depth exploration.

Over the past decade, the median price of an HDB flat in Singapore has seen an alarming increase of 50%. Simultaneously, the median income of Singaporeans has only grown by 20%, creating a widening chasm between earnings and housing costs. Consequently, the affordability ratio — the proportion of income required to service a mortgage on an HDB flat — has decreased by 30%.

Decoding the Affordability Ratio

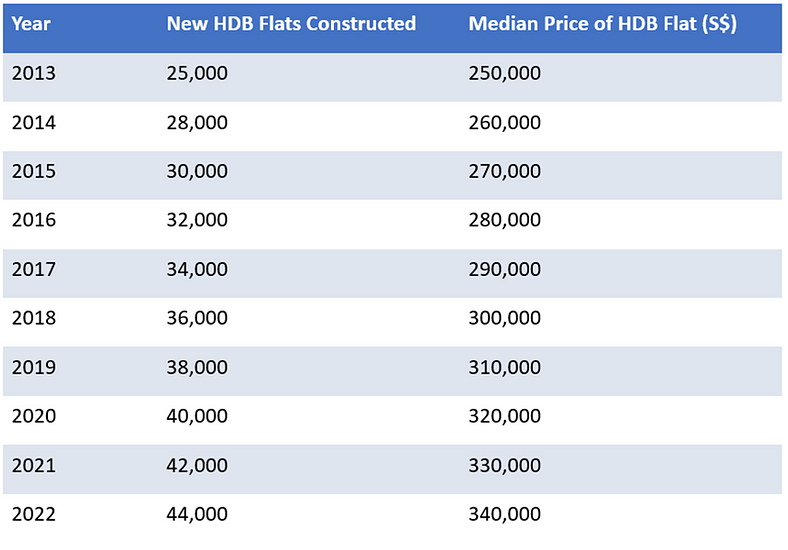

Understanding the affordability ratio is pivotal to the broader issue at hand. In 2013, the median price of an HDB flat stood at S$250,000, and the median income was S$4,000 per month. This translated to an affordability ratio of 62.5%. Fast forward to 2022, and the median flat price had risen to S$340,000, with the median income slightly increasing to S$4,900 per month. This resulted in an affordability ratio of just 53.5%.

This declining affordability ratio over the years indicates that more of a Singaporean’s income is now required to afford an HDB flat. While rising land and construction costs and increasing demand for HDB flats have contributed to this decline, stagnant income growth remains a significant factor.

Government Initiatives: A Helping Hand or a Drop in the Ocean?

The Singapore government has taken steps to address this affordability issue. Subsidies for first-time buyers, such as the Enhanced CPF Housing Grant and efforts to increase the supply of HDB flats, are commendable initiatives. However, the persistent decline in the affordability ratio suggests more than these measures might be required.

The Road Ahead: A Housing Conundrum

The rising cost of HDB flats is a significant concern for Singaporeans, and the government’s efforts to address this issue are under the spotlight. While the state’s commitment to maintaining affordability is well recognised, the effectiveness and timeliness of these interventions remain uncertain. The question then is not just how long it will take for the government’s measures to impact HDB flat affordability significantly but also whether these measures will be robust and flexible enough to meet future challenges.

Conclusion

In conclusion, the affordability of HDB flats in Singapore is a complex issue rooted in economic, social, and policy factors. As Lion City navigates this housing problem, the global community watches closely, drawing lessons for their affordable housing initiatives.

Reference

“A Guide to the Enhanced CPF Housing Grant (EHG)”, 21 May 2021, MyNiceHome, https://www.mynicehome.gov.sg/hdb-how-to/buy-your-flat/a-guide-to-the-enhanced-cpf-housing-grant-ehg/

“HDB Resale Statistic”, Housing Development Board, https://www.hdb.gov.sg/residential/selling-a-flat/overview/resale-statistics

“Summary Table: Income of Singaporeans”, Ministry of Manpower, Jan 2023, https://stats.mom.gov.sg/Pages/Income-Summary-Table.aspx

“HDB resale flat prices propped up by ‘unrelenting interest’ in million-dollar deals: Analysis”, CNN, 28 Oct 2022, https://www.channelnewsasia.com/singapore/hdb-resale-flat-prices-strong-demand-million-dollar-transactions-property-3030186