Find out how China’s new digital currency works and how it differs from other third-party e-payment apps.

China’s Digital Yuan, otherwise known as electronic Chinese Yuan (e-CNY) or Digital Currency Electronic Payment (DC/EP), is a blockchain-based digital currency launched by the People’s Bank of China. Its value is equivalent to RMB bills and coins.

Special note: as only the selected personnel can download and use this app, the following pictures are all taken from the internet.

How to use the e-CNY

1. Registration

Winners can download the e-CNY app through the official links, and iPhone users can use the given exchange code and download it through App Store. Upon successful installation, enter your phone number and name to complete the registration.

2. Deposit

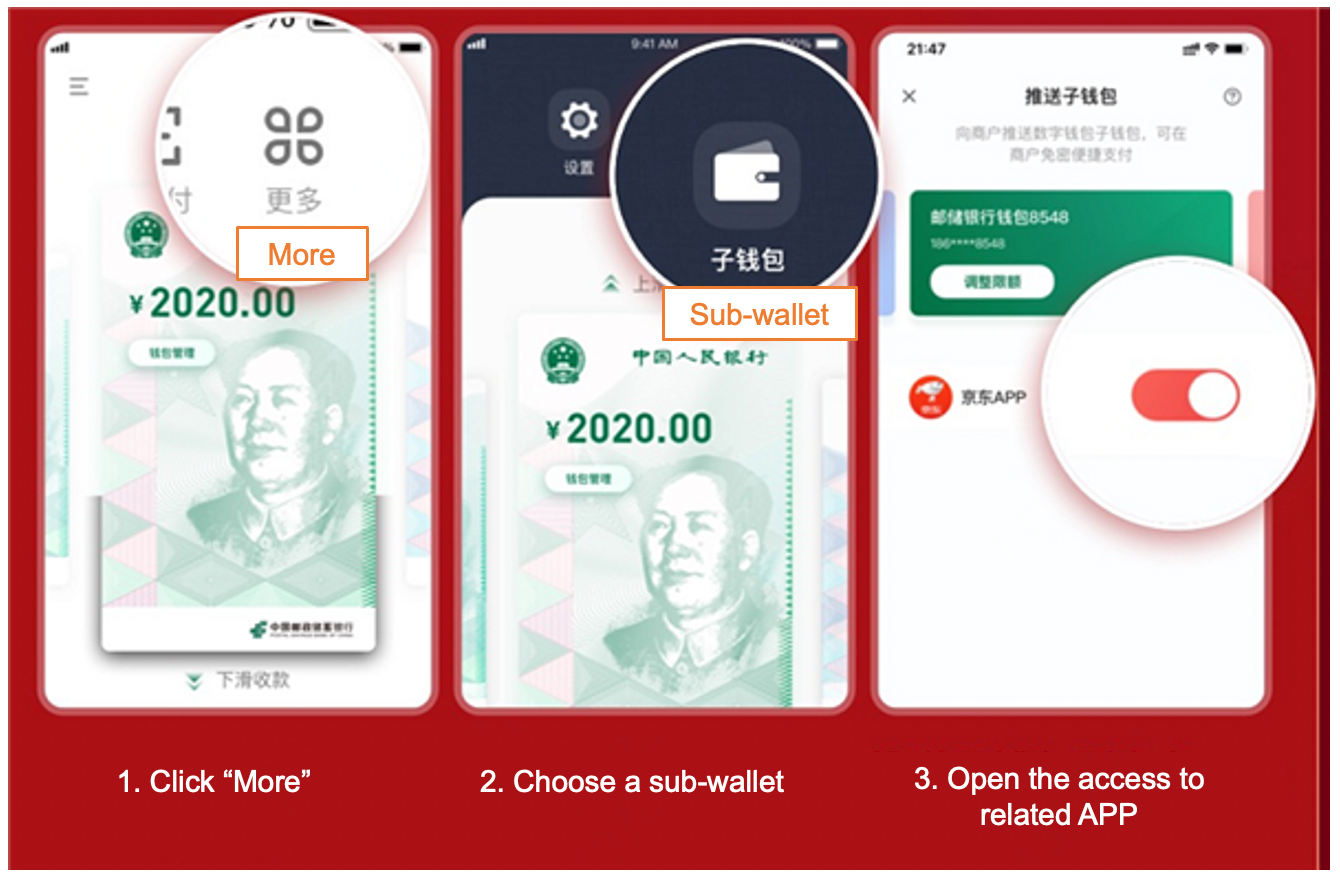

Select a bank to create a sub-wallet. The available choices include China’s six major state-owned banks and Ali’s MYbank. Access to Tencent’s Webank is in progress. User can create multiple sub-wallets and top up e-CNY through the corresponding bank account.

3. E-CNY for physical payments

E-CNY is accepted as a payment method in most shopping malls, supermarkets, convenience stores, restaurants, and food markets in pilot cities. Merchants that accept this form of payment will have a label to show that e-CNY payments are available at the checkout counter.

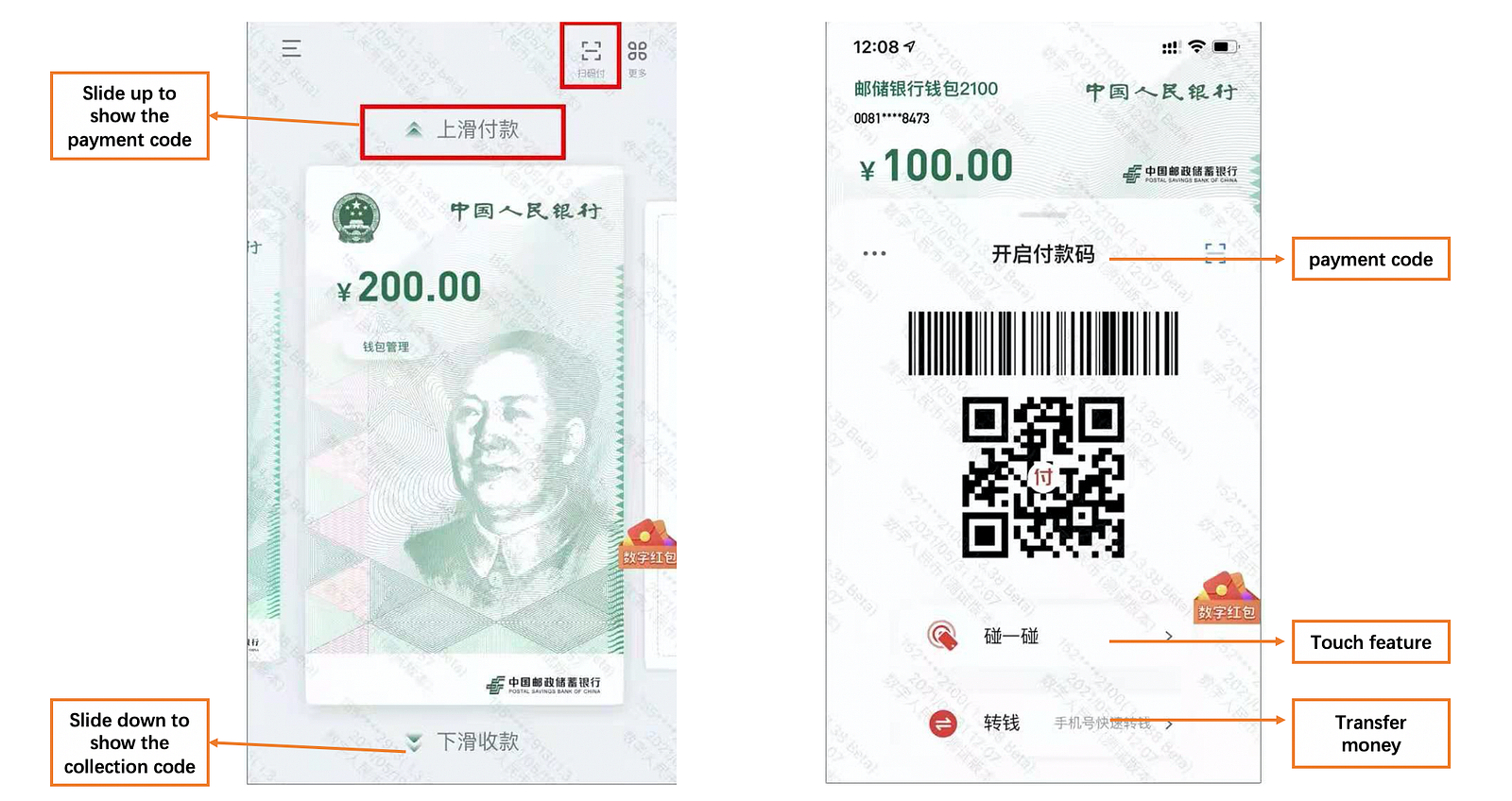

1) Scan the merchant’s QR code

2) Show the user’s payment code, and the merchant can scan the QR code on the screen, or

At present, e-CNY is integrated into Alipay and Jingdong, two of China’s most popular mobile apps. The six major banks also have their affiliated mobile apps such as Meituan, Bilibili and SF Express. Users can click “More” in the upper right corner and then select a sub-wallet to see other mobile applications that support the use of e-CNY. Upon turning on the access to an app, the payment option of “e-CNY” will be displayed in the chosen app.

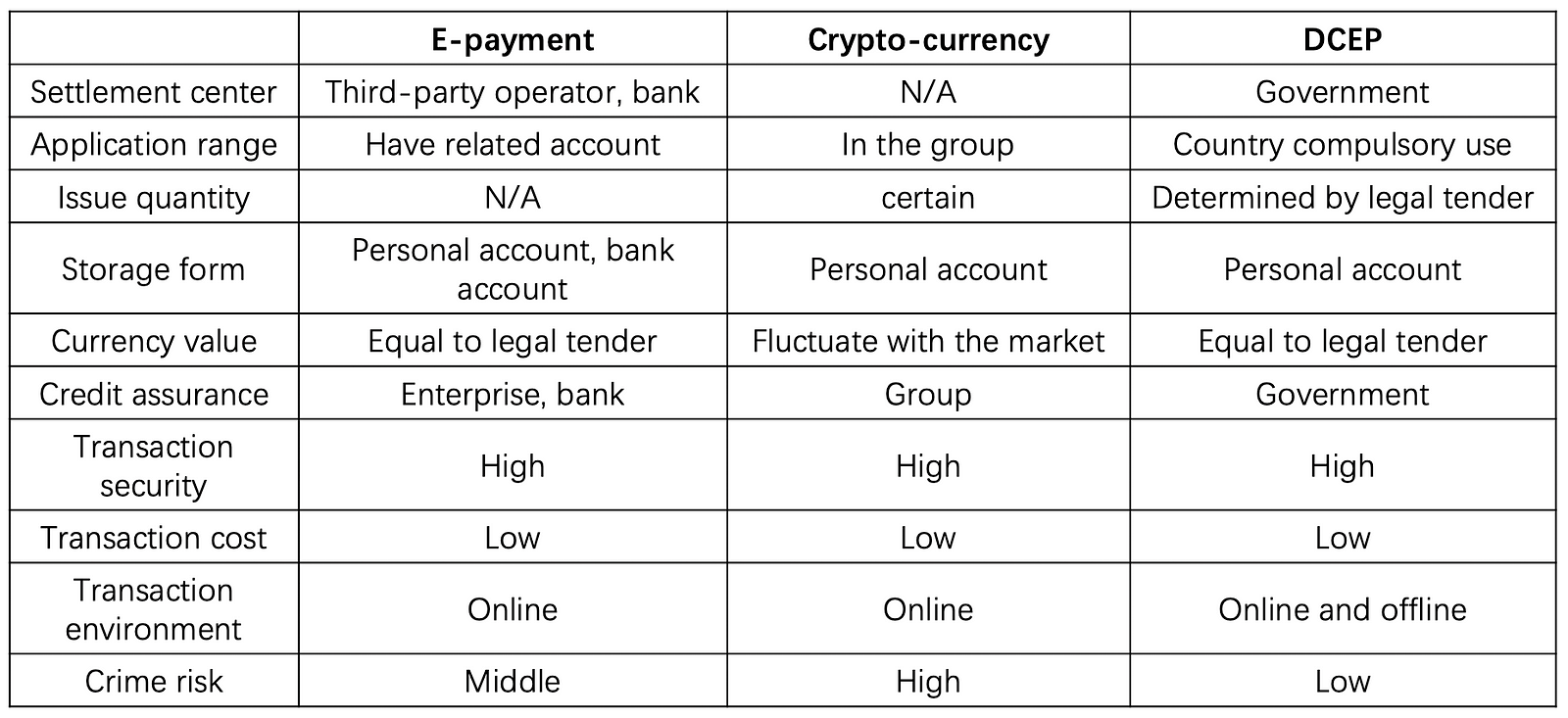

People who are used to e-payment tools may find this just like any other typical third-party payment. Is it just a government initiative to monitor the capital flow of ordinary citizens? Or is it an attempt to grab a share in the online payment market? These are some questions raised by the Chinese citizens. However, the e-CNY remains quite different from third-party payment apps. Simply put, third-party e-payment apps such as Alipay, WeChat, and PayPal, are e-wallets, while e-CNY is a currency. We shall dive into the five characteristics of e-CNY in detail.

1. National legal tender

E-CNY is China’s legal currency issued by the People’s Bank of China. Therefore, if e-CNY is implemented on a national scale, Chinese citizens have no rights to object. In contrast, third-party e-payment software does not have similar legal authority.

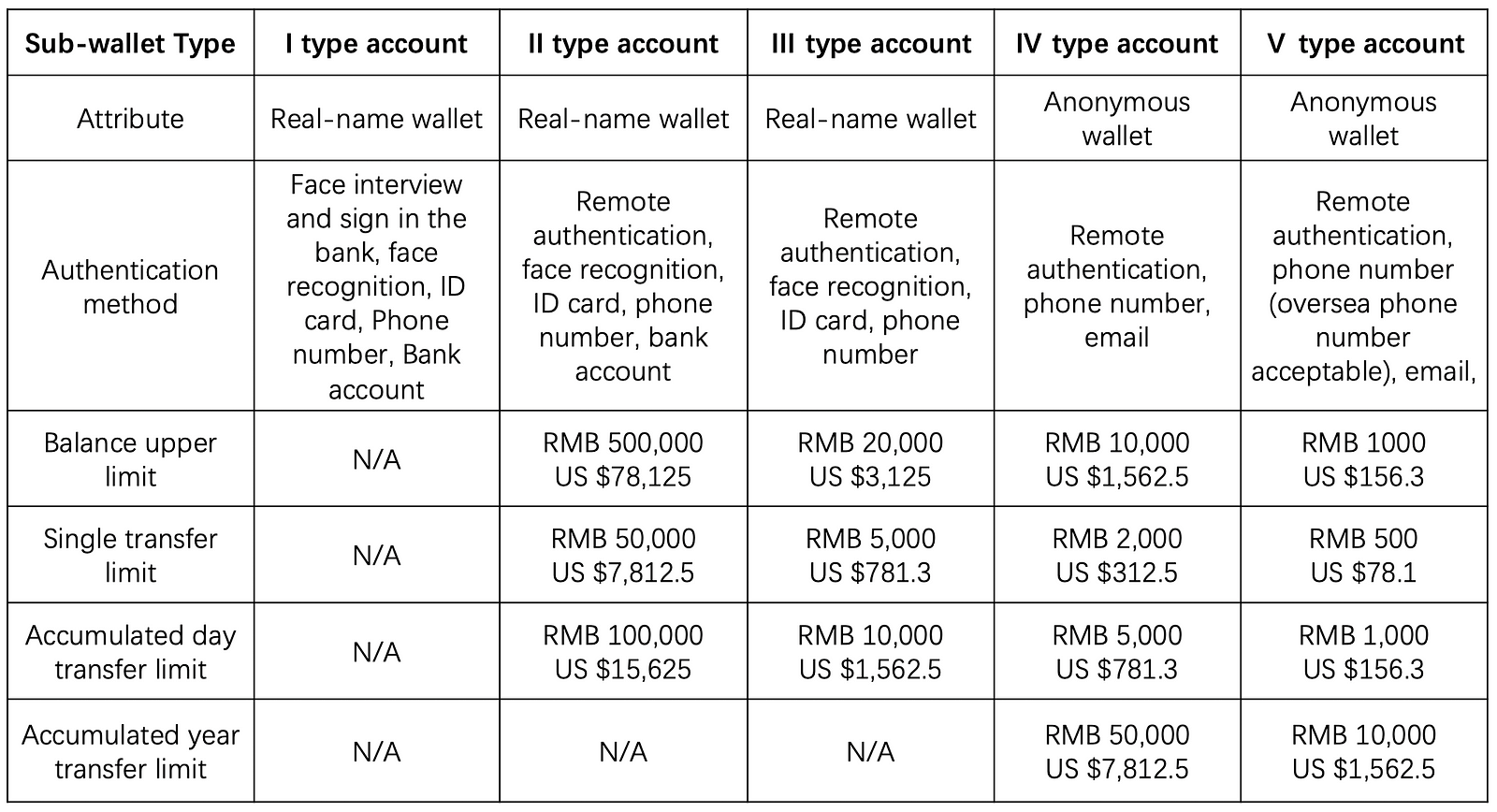

2. Increased anonymity

Due to strict control, Alipay and WeChat both require real-name authentication, with some functions that even require users to bind a bank account. For example, the “red packet” function in the WeChat group can only be accessed after binding the account to a bank card, regardless of the payment amount. On the other hand, e-CNY only requires the user’s mobile phone number and name for registration. Real-name authentication is not required for amounts under RMB 2,000 (US$312.5). Of course, as the amount increases, more personal information is necessary as this linked to the country’s crackdown on money laundering and tax evasion.

Two mobile phones equipped with the e-CNY app can transfer money through the phones’ physical contact without needing any Wi-Fi signal. In addition, for merchants that have opened the “touch” function, users can make payments by touching the relevant sensors with their smartphones.

4. No need for a binding bank account

Although e-CNY currently requires users to deposit through a bank account, its existence and functionality should be independent of any bank. Third-party e-payment apps such as Alipay are different because they must access a bank card to function.

5. No fees and interest

A handling fee of about 0.1% is charged for cash withdrawal from third-party apps to bank accounts. Although some users enjoy no handling fee up to a fixed amount, this does not apply to everyone, and it makes third-party payment less attractive. To attract users, third-party apps usually will launch many financial products. Users can also get some interests if they deposit their money in those apps. E-CNY is different because it has no interest and no handling fee. It is purely a form of digital currency.

In short, e-CNY is the digitization of paper money, and its current focus is on facilitating day-to-day payments in the retail sector.

As the digital currency is still in its infancy phase, e-CNY and paper money are expected to coexist for a long time. For ordinary citizens, e-CNY adds to the plethora of payment options in China. Once implemented on a national scale, users no longer have to worry that merchants do not accept such a payment method or that digital payment does not go through due to Wi-Fi signal issues.

Short-term visitors to China will no longer need to exchange currency. E-payments can be made through e-CNY without real-name authentication, unlike other local payment apps that require a mainland ID card and bank account to use the app.

Chinese citizens are generally used to the convenience of e-payments. Common services such as bike-sharing and unmanned stores only accept digital payment methods. As e-payments are relatively common in China, the integration of e-CNY should not be difficult.